Why choose us

Our Virtual Data Room Service solves complexity of storing, sharing and managing highly confidential & large data sets

Investment Banks

Investment Banks

Investment Banks

M&A life cycle can be overseen all the more effectively using M&A Virtual Data Rooms, which can assume a key role in dealing with each stage of this lifecycle, beginning from the preliminary stage to a fruitful post-deal closure stage. M&A life cycle can be overseen all the more effectively using M&A Virtual Data Rooms, which can assume a key role in dealing with each stage of this lifecycle, beginning from the preliminary stage to a fruitful post-deal closure stage. M&A is a process to consolidate companies or its assets via multiple financial transactions.

Read more Finance

Finance

Finance

A Virtual Data Room (VDR) is an important tool for boards to communicate in today's business world. Board members can view and share sensitive documents, financial reports, strategic plans, and other important information on a safe and efficient platform. VDRs are made to make it easy for board members to work together by giving them access to data in real time from anywhere in the world. When you use Virtual Data Room for Board Communications, you can keep your data organized, make it easy for the right people to view it, and keep it safe.

Read more Private Equity

Private Equity

Private Equity

Bankruptcy and Restructuring project management is a very complex process and requires a high level of confidentiality & compliances. It gives everyone involved a safe place online to handle and share important documents, contracts, and financial records. This includes creditors, debtors, legal teams, and financial advisors. VDRs are very important for handling the complicated processes of bankruptcy and restructuring. They make decisions more quickly and help everyone figure out how to get their money back.

Read more Legal

Legal

Legal

Due Diligence is a process to investigate the facts of any matter to ensure transparent & fair decision making. Due Diligence is being practiced in almost every industry like Finance, Biotech, Real Estate, Energy, Legal IT etc. There might be different Due Diligence checklists based on industry and objective of data validation. For businesses, it's a safe central location where they can easily store, organize, and share private files and details with possible buyers, investors, or partners during mergers, acquisitions, or investment deals.

Read more Life Sciences

Life Sciences

Life Sciences

Securing data in Life science & Healthcare companies is as important as working on mission critical medicines to serve humanity. VDR in Life Science plays a very important role in securing sensitive data. VDR in healthcare not only helps in securing critical data like clinical trials but also helps in IPO, Fund Raising, Mergers & Acquisitions, IP licensing and Regulatory communications. They enable streamlined due diligence processes during partnerships, licensing agreements, or mergers and acquisitions, facilitating the exchange of critical scientific and regulatory information.

Read more Real Estate

Real Estate

Real Estate

Real Estate projects involve a large number of documents sharing with multiple internal departments, contractors, financial institutes and government departments. In the first place, storing and sharing large data sets with many people is a very tedious task and making it secure makes it even more difficult. By enhancing transparency, mitigating risks, and expediting transactions, VDRs empower real estate professionals to make informed decisions and manage properties with confidence in an increasingly competitive and data-driven industry.

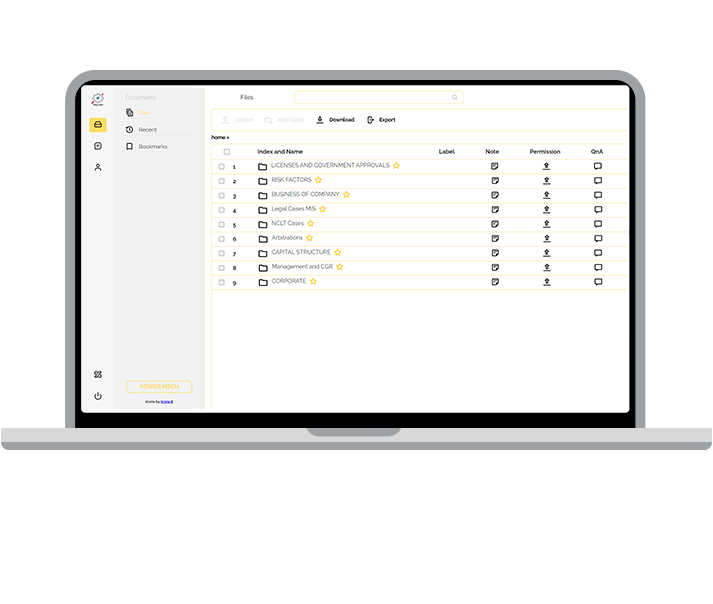

Read moreDocument Management

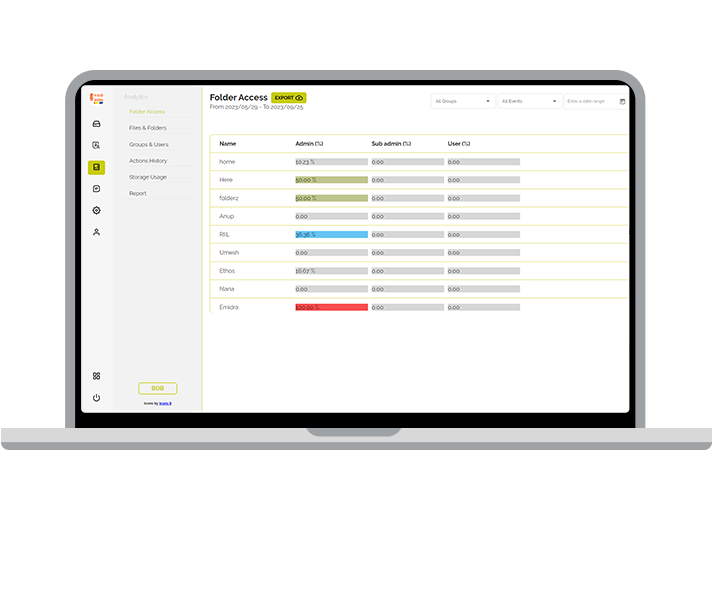

Reports

Access Security

Document Security

Help Guides

Our online data room is well explained by this quick process

1

Upload Files or Folder

Upload large numbers of files in data rooms with secure document sharing services.

2

Create groups & Assign Permissions

Create multiple groups & provide role-based access to protected files in our secure VDR services.

3

Start Sharing in Controlled & Secure Environment

Now everything is protected and each activity is monitored, start sharing.

4

Track Each Activity using Advanced & Customized Reports

Get customized reports on activities, access, views, updates, comments etc.

The term “deal room” refers to an online source for document storage and dissemination that is only accessible to authorized parties. Here we are explaining how Virtual data room works:

To store and communicate highly confidential information, a virtual data room (VDR) is an online platform. High-security standards, compliance with government rules, and a wide range of built-in capabilities are all necessary for a safe data storage and secure document sharing environment in the perfect Virtual Data Room.

The following types of information may be found in files and folders:

Because they are organized and readily available, files in a virtual data room are straightforward to find. Our online platform can open a wide variety of file formats, including Word, PDF, CSV, PowerPoint, and Excel.

The administrator has put in place a non-disclosure agreement for the benefit of users and visitors alike. Visitors to the site assume responsibility for their actions by agreeing to the platform’s terms and conditions.

It is necessary to do the following steps in order to create a virtual data room:

A Data Room in M&A, also called a Virtual Data Room (VDR), is a safe digital space where confidential information that is important to a merger or acquisition can be kept and shared among the parties involved. M&A data room providers give online platforms with strong security features, encryption, and access controls to make sure that sensitive documents are kept private and that only the right people can see them.

These VDRs simplify the due diligence process by letting possible buyers, investors, and legal teams review and evaluate important data from a distance while keeping the deal-making process honest.

In a virtual data room, information such as contracts and business documents are stored online in order to share such information with other parties in a secure and/or confidential way (such as with a potential Investor). It is possible to have a data room that is both real and virtual. While data rooms are often used to streamline legal or financial due diligence, they may also serve a variety of additional purposes throughout a transaction.

They may then evaluate the investments they've made in terms of the dangers and opportunities they've opened themselves up to. Before taking any further action, the parties normally agree on a set of data points that will be thoroughly examined.

Investors may feel secure putting their money into VDRs. Regardless of the time of day, location, or kind of device, users may access information on the platform.

The cost of a virtual data room is affected by a number of variables. In addition to contract length and storage capacity, additional factors, such as the availability of technical help, may impact the cost.

Free trial periods are offered by the vast majority of service providers. It is up to the user to decide whether or not this technology is appropriate for their unique needs.

As a result, FirmsData has kept its prices low so that a wide range of customers may benefit. Please check out our pricing page for additional details. FirmsData is a major provider of virtual data rooms (VDRs) due to its affordable costs and bank grade levels of protection.

Our 14-day free trial is available to new customers. Including a credit card is unnecessary. To use the service, all you have to do is sign up and contact us.

FirmsData gives full support for Virtual Data Rooms (VDRs) to make sure that its users have a smooth and safe experience. Most of the time, their support includes helping you set up and customize the VDR platform to fit your needs. You can get help structuring and organizing your data, as well as expert tips on setting access permissions and user roles. Our support team is always ready to help with any technical problems, answer questions, and teach users how to use the VDR well. Also, they usually offer customer service around the clock so that you can get help whenever you need it. This makes FirmsData a reliable partner for your VDR needs.